What makes solar investing attractive?

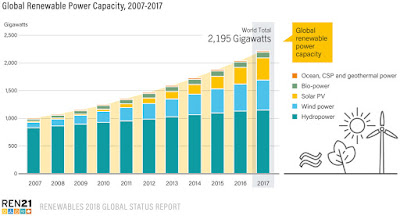

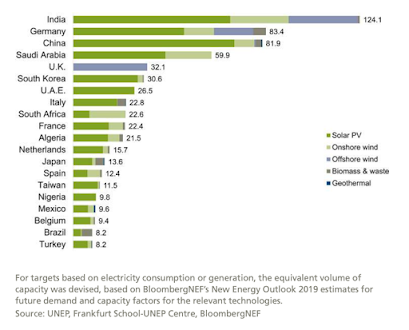

The renewables market is expanding with technological advances and growth opportunities, making it an attractive option for investors and energy customers around the world. Solar investing is slowly becoming a sought after option for portfolio investors because of the following reasons - ● Rapid technological advancements have improved the efficiency and performance of solar plants ● Refined deployment has significantly reduced the cost of deploying solar for energy customers in the emerging markets . The cost is expected to reduce further in the near future ● Governments are introducing energy policies that are favorable for the renewable energy market to broaden their energy mix and explore renewable energy generating sources that are planet friendly ● Renewable energy, including solar is important in tackling the rising electricity tariff rates because of the excessive dependence on fossil fuels. Opting solar power will make great economic sense to c